jefferson parish property tax due date

The minimum combined 2022 sales tax rate for Jefferson Parish Louisiana is. Jefferson Parish LAT-5 forms are due 45 days after receipt.

Jefferson Parish Finance Authority Facebook

Whether you are presently living here only contemplating taking up residence in Jefferson Parish or planning on investing in its property find out how municipal property taxes work.

. You may also print a copy of your tax bill by using the Property Tax Search and Payment. The total number of parcels both commercial and residential is 185245. Inventory is assessed at 15 of the monthly average.

The Louisiana state sales tax rate is currently. When and how is my Personal Property assessed and calculated. If you do not receive a tax bill in the mail by the second week of November please contact our office at 502-574-5479 and request a duplicate bill to be sent to you.

Property taxes for 2020 become due upon receipt of the tax notice. Shopping Purchases made via. Enter an Address to Receive a Complete Property Report with Tax Assessments More.

Jefferson parish property tax due date. Property owners may review their assessments and apply for additional relief during this time. The Jefferson Parish Assessors Office has announced it is opening its tax rolls from September 29 2021 through October 13 2021.

Jefferson Parish LAT-5 forms are due 45 days after receipt. The median property tax in Jefferson Parish Louisiana is 755 per year for a home worth the median value of 175100. Supervisor and Finance Division Commander Danette Hargrave.

Louisiana is ranked 1929th of the 3143 counties in the United States in order of the median amount of property taxes collected. The parish is responsible for collecting all property taxes from the middle of November until the day of the tax sale which is generally held sometime in or around June of each year. Inventory is assessed at 15 of the monthly average.

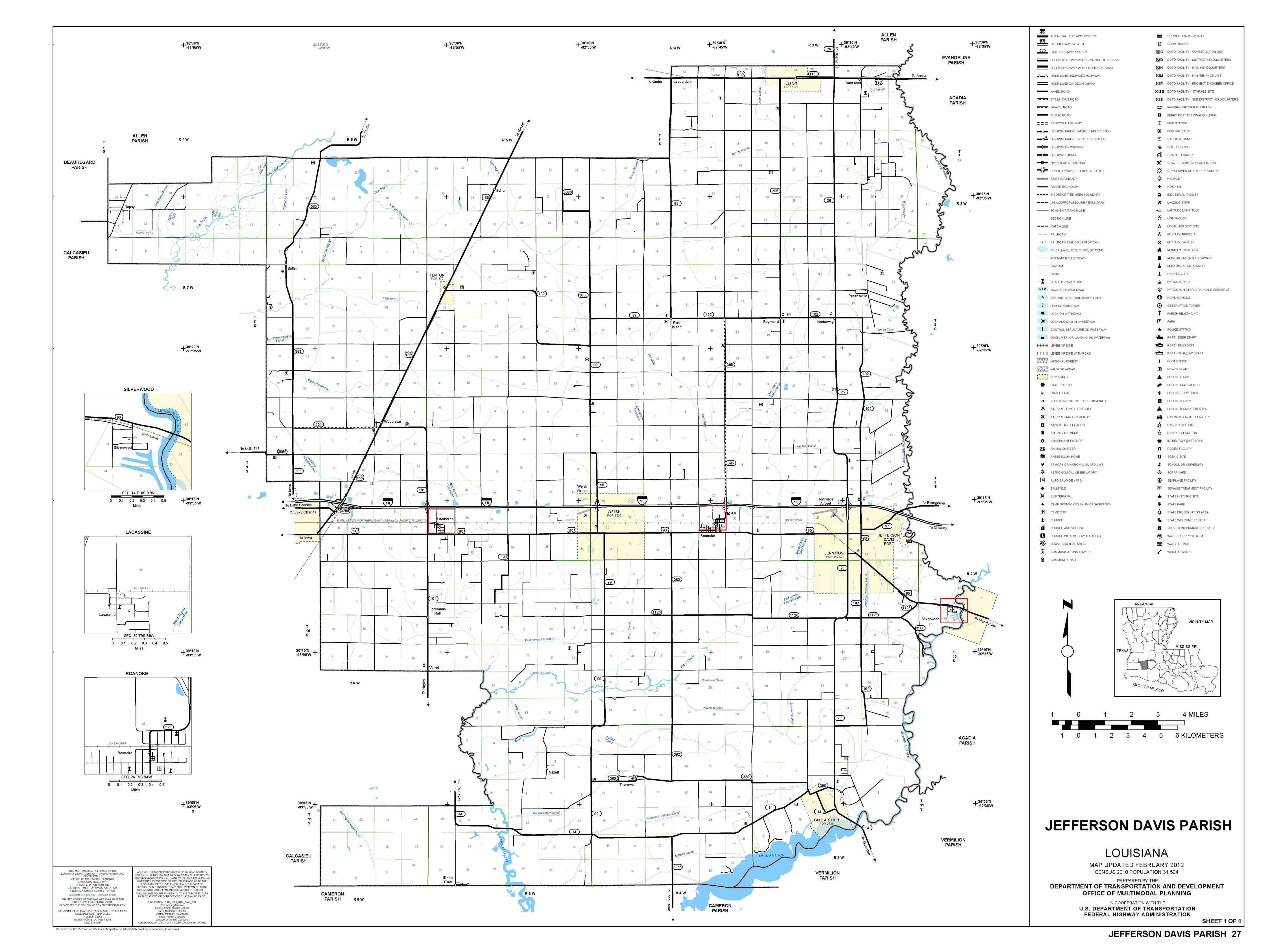

Whether you are already a resident or just considering moving to Jefferson Davis Parish to live or invest in real estate estimate local property tax rates and learn how real estate tax works. Due to the nature of its activity taxpayers are advised to schedule an appointment to discuss delinquent accounts. 35 on the sale of prescription drugs and medical devices prescribed by a physician Property taxes must be paid by december 31.

Other personal property is depreciated according to guidelines set by the state of Louisiana. The Department of Revenue sets the guidelines under WAC 458-18-215. Jefferson Parish collects relatively low property taxes and is ranked in the bottom half of all counties in the United States by property tax collections.

For more information contact the DOR Property Tax Division at 360-570-5900 or you may view the Paying Your Property Taxes Under Protest PDF document from the Washington State Department of Revenue. Jefferson County real estate property tax notices are mailed out in late October or early November by the County Sheriffs Office and are payable to the County Sheriffs Office beginning November 1. Learn all about Jefferson Davis Parish real estate tax.

The 2018 United States Supreme Court decision in South Dakota v. The assessment date is the first day of January of each year. The telephone number is 504-376-2459.

With this guide you can learn useful information about Jefferson Parish property taxes and get a better understanding of what to anticipate when you have to pay. Jefferson Parish Health Unit - Metairie LDH Online Payment Pay Parish Taxes. When and how is my Personal Property assessed and calculated.

To 400 pm Monday through Friday. The median property tax also known as real estate tax in Jefferson Parish is 75500 per year based on a median home value of 17510000 and a median effective property tax rate of 043 of property value. The due date for all registered fillers is the 1st of the month following the close of the calendar month of the reporting period.

Property Tax Information Every year tax bills are mailed in November. The Jefferson Davis Parish Tax Division is under the command of Tax Collection Dept. The Jefferson Parish sales tax rate is.

Property owners may review their assessments and apply for additional relief during this time. When contacting Jefferson Parish about your property taxes make sure that you are contacting the correct office. Ad Search County Records in Your State to Find the Property Tax on Any Address.

This section is located in Jefferson Parish Sheriffs Office Administrative Building 1233 Westbank Expressway in Harvey and is open from 830 am. If the 20th falls on a weekend or holiday the return can be filed on the next business day and would become delinquent the first day thereafter. They become delinquent on January 1 following their due date and are maintained and collected in the County Sheriffs Office until April 15 each year.

Paying Property Taxes Under Protest. Other personal property is depreciated according to guidelines set by the state of Louisiana. Total property taxes owed in Jefferson for 2020 are 4351 million up 05 from 4327 million in 2019.

Lopinto III as the Ex-Officio Tax Collector of Jefferson Parish will begin printing the 2020 property tax notices to Jefferson Parish residents and businesses by Monday December 7 2020. The due date for all registered fillers is the 1st of the month following the close of the this refund is claimed for the following reasons check all that apply. The assessment date is the first day of January of each year.

This is the total of state and parish sales tax rates. Posted by January 20 2022 suit for declaration format on jefferson parish property tax due date January 20 2022 suit for declaration format on jefferson parish property tax due date. If you have documents to send you can fax them to the.

Jefferson Parish collects on average 043 of a propertys assessed fair market value as property tax. A return is considered delinquent after the 20th of the month following the close of the reporting period. Remember to have your propertys Tax ID Number or Parcel Number available when you call.

You can call the Jefferson Parish Tax Assessors Office for assistance at 504-362-4100.

Tax Division Jefferson Davis Parish Sheriff S Office

Jefferson Parish Sheriff S Office Jefferson Parish Sheriff S Office

Faqs Jefferson Parish Sheriff S Office La Civicengage

Tax Division Jefferson Davis Parish Sheriff S Office

E Services Jefferson Parish Sheriff La Official Website

Jefferson Parish Clerk Of Court Forms Fill Online Printable Fillable Blank Pdffiller

Faqs Jefferson Parish Sheriff S Office La Civicengage

297 Million In St Tammany Tax Bills To Hit Home This Week One Tammany Nola Com

Jefferson Parish Finance Authority Facebook

Faqs Jefferson Parish Sheriff S Office La Civicengage

St Tammany Sheriff S Office Once Again Set To Hold Tax Sale Online Wgno Com

Jefferson Parish Voters Approve Water Sewer Taxes Westwego Picks New Mayor